WHITE PAPER

09/2015

Connected Finance Reference Architecture

By Asanka Abeysinghe

VP, Solutions Architecture, WSO2

Table of Contents

With advances in technology, a customer's requirement is not just good customer service;

they're constantly looking for ways to easily interact with their respective banks on the go

and carry out all banking transactions online. Customers today want to feel empowered and

want to do things on their own, prompting banks to increasingly incorporate the concept of

self service for all banking requirements. Customers today are also opting for systems that

are socially connected as well as simple and useful.

On the other hand, while financial enterprises would aim to provide an efficient service

to their customers, they have their own technology challenges that need to be addressed

as well. In the long run, financial enterprises' ultimate goal would be to develop a nextgeneration

financial infrastructure that will seamlessly connect with all the backend systems

in place and in turn, offer value added services to customers.

Mobility - Today many people use mobile and smart devices to carry out their financial

activities. Hence, all data and systems should be able to facilitate this requirement.

Location - Customers today deal with different financial institutes and do this on the move

as well. Therefore, they need to be able to access their data from wherever they might be.

Connectivity - Based on the location and need, customers might use different financial

institutions. Hence, these institutions should be able to communicate with each other and

share information; therefore, connectivity between these institutions is key.

Social - Social features are required with financial applications and are becoming

increasingly popular in this domain, e.g. technology today allows you to take a picture of a

cheque, upload, and deposit it in your account.

Virtual payments - This has been increasing and all backend systems should be able to

support old virtual payment systems as well as the current ones coming into the market today.

Mobile payments - A mobile payment ecosystem is not simple and has to integrate with

many systems as well as be secure due to the sensitive nature of the business. Most people

use this function for their financial transactions, hence financial systems should be able to

support current mobile systems (including devices and sensors) as well as new systems that

will enter the market in the future as well.

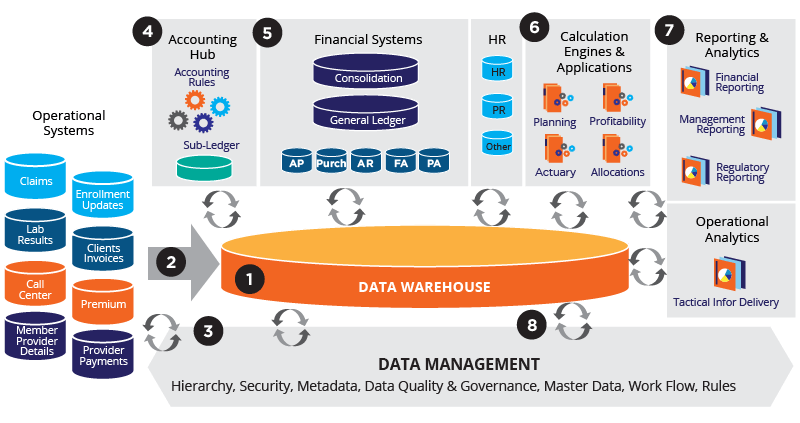

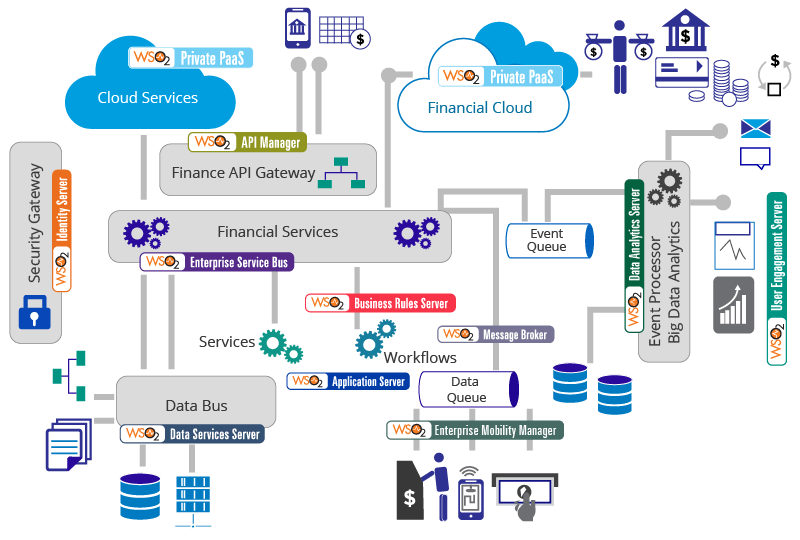

To address the challenges explained above, your enterprise would need to be able to

connect everything to a central ecosystem to facilitate a real-time system as opposed

to a batch-mode one that was prevalent in the old world architecture. To this end, your

enterprise would require a next-generation financial infrastructure, as depicted in Figure 1,

that will connect all backend systems. These would typically include day-to-day operations

like HR and CRM systems and financial-related applications that come from the old world

as well as many new systems that would eventually be included. There are also various

business user needs, such as dashboards and reports, which would require you to pull out

data from the current repositories and provide these in a format that would meet business

user requirements; such requirements would include reporting, monitoring, managing,

etc. Another key feature is a bigdata store with different types of data formats that come

from the old world as well as new applications, hence the enterprise would need some

sort of master data management as well as ETL-type solutions built on top of the data

that's available. Moreover, the infrastructure would need to include regular, day-to-day

functionalities as well as call center-type functionalities, virtual payments, credit card

payments, payment gateways, etc.

The first step in this direction is to connect everything in different systems, thus

connectivity is crucial in building your next-gen finance architecture. There are many key

backend components that need to be seamlessly connected:

Services and APIs - In terms of services and APIs, in the modern world, services are

implemented and APIs makeup the consumable unit; therefore, enterprises would typically

expose all back-end functionalities as a service and then services are exposed as APIs.

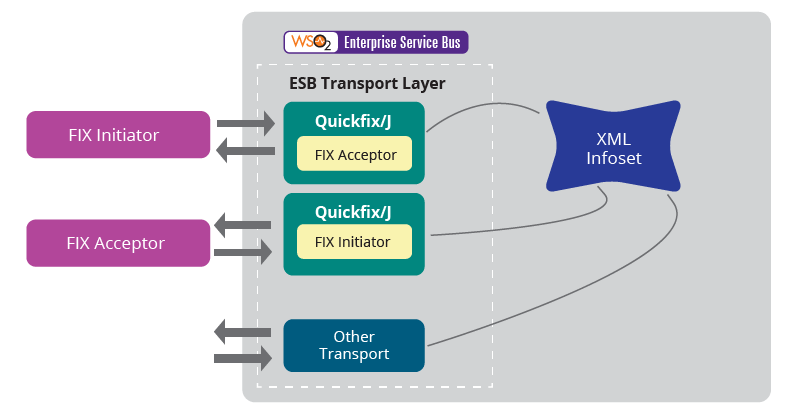

Financial protocols - There are many financial protocols that your connectivity or

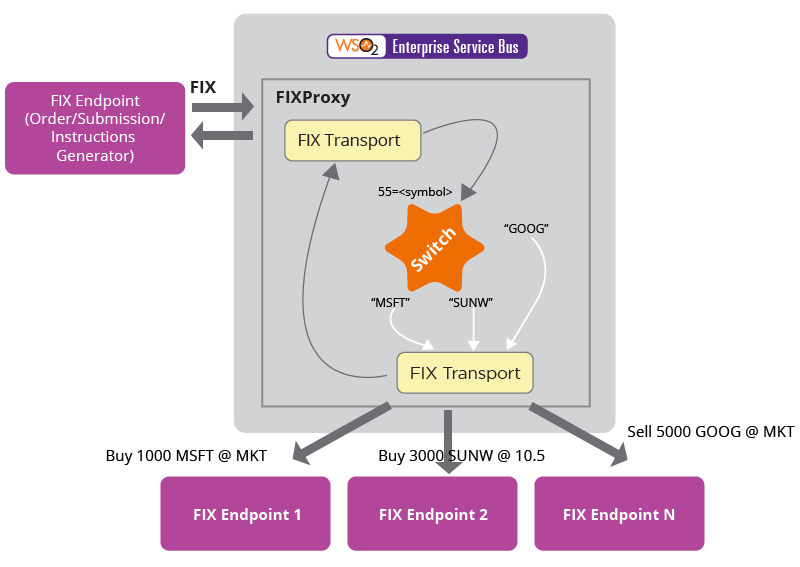

the integration should be able to support, e.g. as in the diagram shown in Figure 2,

the integration layer should be able to support common protocols, such as (Financial

Information eXchange) FIX and subsets of this like FpML and FIXML. Although most backend

systems work with financial protocols, modern application systems that you would

bring in would use open standards like HTTP, JMS, MQP, MQTT, etc.

Figure 02

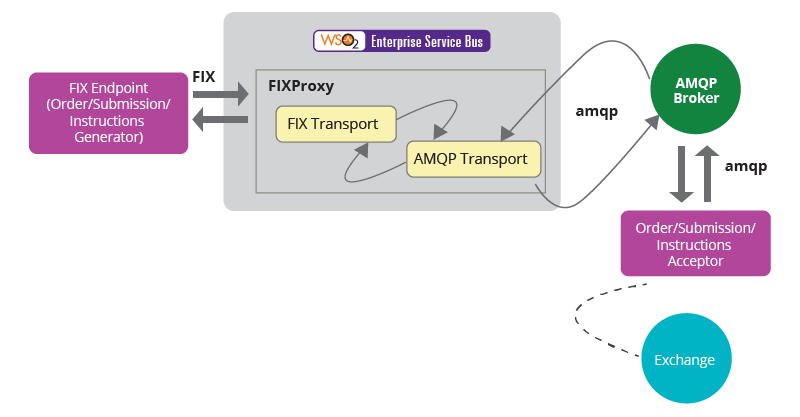

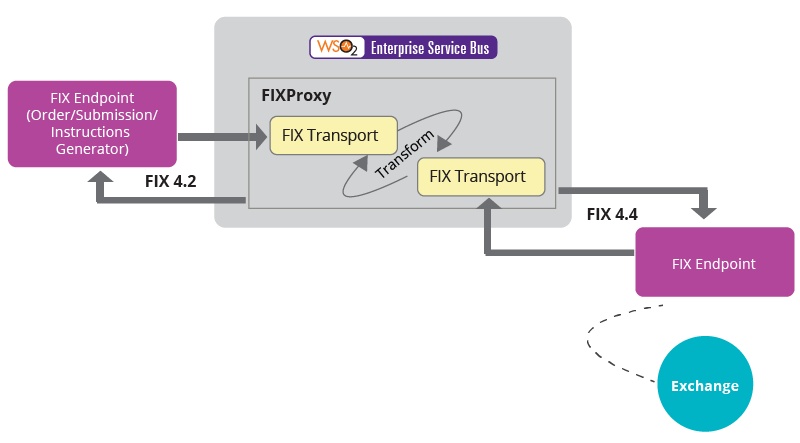

Bridging financial protocols with open protocols - You can describe which parts of your

financial message or protocol bridges into the open standard (SOAP, REST, etc.) and do the

conversion. Figure 2 illustrates an example of converting FIX to HTTP and Figure 3 shows

another use case of how FIX can be converted into AMQP for instance, which has become a

popular protocol in the financial sector today.

Figure 03

Bridging security - Your enterprise might be using different security standards, therefore

you would need to bridge security between these different systems, e.g. backend systems

might be secured using Kerberos and the frontend might be using an OAuth or SAML type

of security.

Cloud connectors - There are many cloud applications that support business functionalities,

including those in the financial sector. Therefore, your internal systems need to connect

to the cloud via a set of cloud connectors. Given that the financial industry is a highly

regulated one, there might be limitations on how much data you can move to the cloud and

some data may need to be maintained in local data centers. In such situations, it's useful

to use a hybrid deployment where some processes and data are run in your data centers

and some are moved to the cloud with proper processes for those architectures; you would

then need to bridge the cloud and data centers using a secure channel.

of security.

Secured connectivity - All connectivity needs to be secured via a proper way of securing

and then sharing messages across systems due to the sensitive nature of the industry

of security.

Support patterns - Integration is primarily built on top of enterprise integration patterns

and message exchange patterns; therefore, any technology or architecture should be able

to support integration as well as message exchange patterns, such as request/response or

publish/subscribe type of message exchange patterns.

Routing - You might need to route messages and this can be header-based as well as

payload or message-based routing as well. You can also use different rule sets in the

integration to enable static or dynamic routing too, e.g. as illustrated in Figure 4, based on

the symbol, a message will be communicated to the trading floors. Likewise, it can be in the

form of a header or a value in the message body as well.

Figure 04

Unification - You might be communicating using a specific financial protocol version, but

internally be using a different protocol. Therefore, you would need some sort of mediation

to bridge the different versions as shown in the example in Figure 5. To this end, it's

useful to have a unification internally and plug in different versions externally to enable

communication.

Figure 05

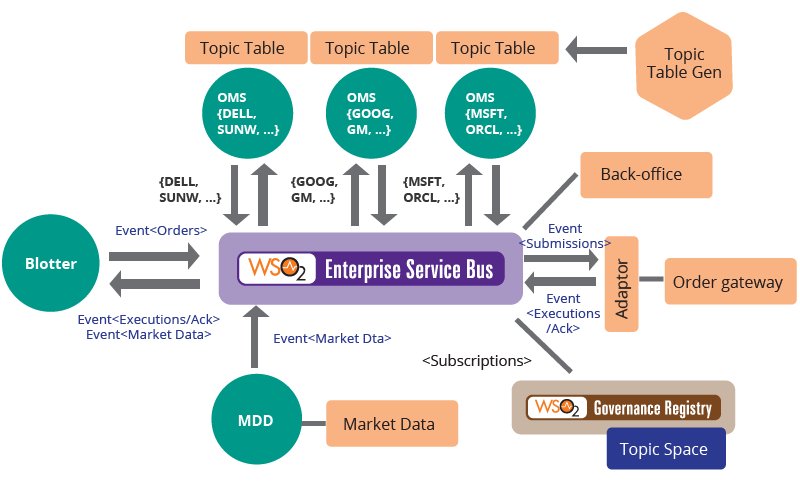

Event-driven architecture (EDA) is very useful in the financial sector given the time

sensitive nature of the industry and because all transactions are carried out real-time. EDA

started out with publish/subscribe and the architecture was enhanced to an event-driven

one, thus acting as a hub for multiple systems and thereby enabling updates to different

aspects of information in a given entity. It allows an enterprise to have a proper looselycoupled

architecture as well as a connectivity layer that you can change based on the

dynamics of your business.

Figure 06

The example in Figure 6 is an illustration of how the WSO2 platform supports EDA; this

example uses symbols as the topics for subscriptions. Here, you can determine how you

would want to rearrange your topics because everything is loosely coupled based on

the subscription. This enables you to create your topic hierarchy on a daily basis and get

subscribers to subscribe to events they are interested in; this way the processing of events

are efficient as only the messages the subscribers are interested in will be accepted.

Moreover, you can bring new systems into the existing one without any impact on others. A

new system will come in and start subscribing to a set of messages and will start processing

these; if you want to send these messages back to the system, it will send back to an

existing topic, or create a new topic.

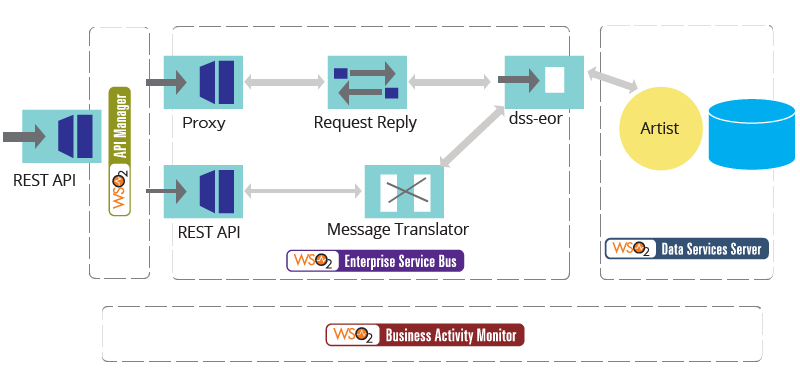

Monitoring - Gateway Pattern

In terms of monitoring your connectivity, the gateway pattern (explained in Figure 7) is an

advantage as it requires every transaction to flow through the same layer, e.g. you have

different systems and subsystems in two sections as well as different protocols; these would

be connected by the mediation layer, which can use routing, smart routing, transformation,

and persist as well; the API manager would act as your gateway. The gateway pattern in

this instance is particularly useful to monitor, manage, and govern financial transactions

as these would go through the same gateway layer (i.e. gateway of gateways or cluster of

gateways).

Figure 07

WSO2 provides a complete product stack that fits well into a reference model of a

connected finance architecture. Figure 8 depicts how modern business requirements map

into a connected finance reference architecture. This diagram shows a data layer and the

identity layers and many financial clouds, where you could use WSO2 Private PaaS and

the dashboards. WSO2 User Engagement Server can be used to build all your analytics

needs; the statistics and data that you store can be processed real-time and near real-time

using WSO2 Data Analytics Server. WSO2 Message Broker will be your message hub that

supports all financial protocols according to your business needs. Workflow processes

are handled by WSO2 Business Process Server. The data layer is integrated using WSO2

DSS and WSO2 Applications Server can be used to write services using different service

standards. You can expose your financial APIs using WSO2 API Manager and WSO2 ESB

will act as the core integration component in this architecture.The WSO2 middleware platform also supports certain standards that govern the insurance

industry (a sub-sector of the financial industry space) developed by the Association

for Cooperative Operations Research and Development, the global industry’s

nonprofit standards developer. ACORD develops and maintains standards for electronic

exchange of insurance data between trading partners; these standards are widely used

within the US as well as across other countries.

Figure 08

Enterprise Cloud Platform

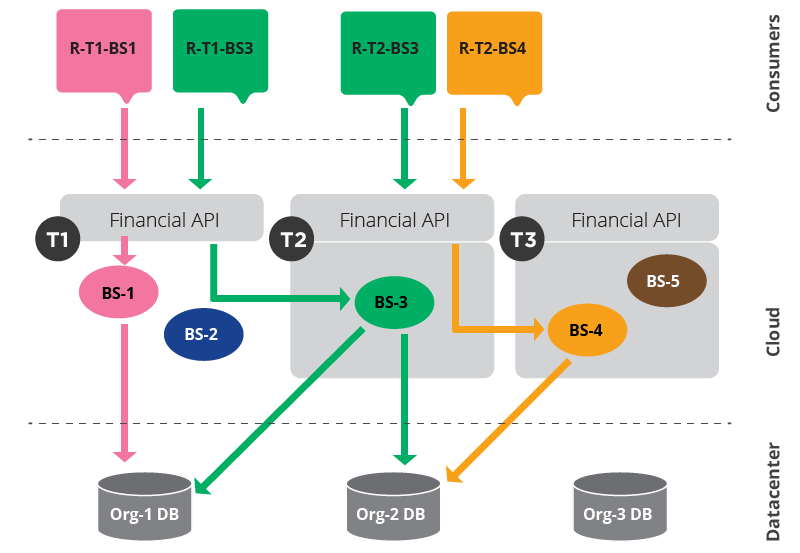

WSO2 offers a complete cloud architecture; Cloud today has become a necessity and

you can build a cloud using WSO2’s cloud platform that’s offered as a private PaaS or the

public cloud. As explained in a previous section, for the financial industry, a public cloud

deployment might not be an ideal option given the nature of the industry. Hence, the

private cloud running in a local data center or a private cloud hosted in a public hosting

place might be the more suitable options. Thus, given the tight regulations in the financial

industry, a hybrid deployment pattern (as shown in Figure 9) would be useful where you

would run some processes in your data center and move some of them to the cloud and

bridge these via a secured channel.

Figure 09

6. Conclusion

To be able to meet customer as well as internal requirements, financial industry players

should adopt a system that’s made up of a series of smaller systems that’s easy to manage,

scale, and maintain. The industry, requirements, consumer space, competition, and

regulations are constantly changing and industry players need to adopt a platform that’s

lean and flexible. WSO2 offers a complete platform that implements the standard and

provides the components and toolkits required to build a connected business.

The WSO2 platform allows you to support systems running both internally and externally

without having to worry about including additional components. WSO2 doesn’t just offer

an ESB or API manager, rather a complete data to screen platform. WSO2 can complete

your integration story and help you become a connected business through its platform and

through collaboration with providers, delivery channels and your partners, cloud offerings,

and in-house legacy applications.

For more details about our solutions or to discuss a specific requirement

![]()